- #Small business bookkeeping excel manual#

- #Small business bookkeeping excel software#

- #Small business bookkeeping excel free#

We provide third-party links as a convenience and for informational purposes only. Readers should verify statements before relying on them.

#Small business bookkeeping excel free#

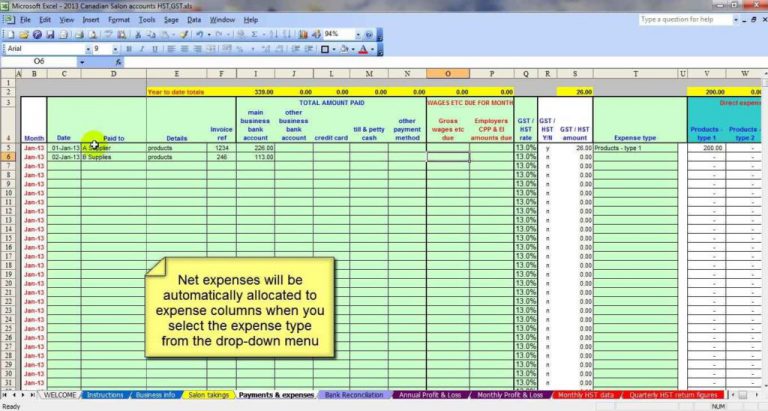

does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Accordingly, the information provided should not be relied upon as a substitute for independent research. does not have any responsibility for updating or revising any information presented herein. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Applicable laws may vary by state or locality. Additional information and exceptions may apply. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. With better tools, the amount of hours spent on accounting goes down, and the time-value cost decreases accordingly. Not only is this steep, but it also doesn’t account for the missed opportunity costs that come from not being able to spend that time on sales, marketing, or hiring. In this case, you’re dedicating $20,000 strictly to entering accounting information.

Hypothetically, the employee earns $20 per hour and works for 50 weeks out of the year. Because the employee has to manually enter information into Excel, they work 20 hours per week. Let’s say you have an employee who works part-time completing financial work. Just how much does this cost small businesses? Not only does this take time, it increases the risk of error as well.

#Small business bookkeeping excel manual#

This means that everything from expense reports to the chart of accounts requires manual entry. If you practice double-entry bookkeeping, as required by the Generally Accepted Accounting Principles, you’ll need to enter every transaction twice. You’ll need to enter every business expense by hand. Unfortunately, Excel requires a lot of working hours. Those hours are hard to quantify but crucial to your sanity. It’s all about how much time it requires to manage. The cost of a tool like Excel has nothing to do with the sticker price.

#Small business bookkeeping excel software#

On average, 1 in 10 say they waited too long to automate these systems and invested in software too late. Seasoned business owners strongly recommend using automated software for expense tracking, invoicing, and payroll, according to a 2020 QuickBooks survey. If you’re still on the fence, consider this. You’ll soon be faced with a business decision - should you spend time and effort dealing with MS Excel and the risks associated with it? Or should you transpose all of your business’s financial information into accounting software? However, as your business begins to grow, you’ll quickly realize that you don’t have the time to deal with the manual labor required to maintain Excel. When you first start your business, it’s the most accessible bookkeeping spreadsheet available. Best of all, you probably already have it. It’s been around for ages, there are plenty of tutorials and Excel templates online, and it’s easy to find sample accounting formulas. This is especially true for new small business owners. Ouch.įor many small businesses, Microsoft Excel (or Google Sheets) is the default choice for bookkeeping. Morgan Chase lost over $2 billion due to a spreadsheet error, which was compounded because a single miscalculation was fed into other calculations. According to The Telegraph, “a member of staff made a single keystroke mistake and entered ‘20,000’ into a spreadsheet rather than the correct figure of 10,000 remaining tickets.” The past decade has been rough for business spreadsheets.įirst, the London Olympics accidentally sold 20,000 tickets to a swimming event that could only accommodate 10,000.

0 kommentar(er)

0 kommentar(er)